5 Top Stock Trades for Wednesday — Is Procter Finally a Buy?

Tech stocks rebounded slightly while bank stocks lost some traction Tuesday. After a few good days for banks and a tough few days for tech, that’s not much of a surprise.

What could really shake things up though? Apple (NASDAQ:AAPL), which reports after the close. We’ll address that stock after we see the numbers. For now, let’s look at some top stock trades for companies that have already reported earnings this quarter.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Top Stock Trades for Tomorrow #1: P&G (PG)

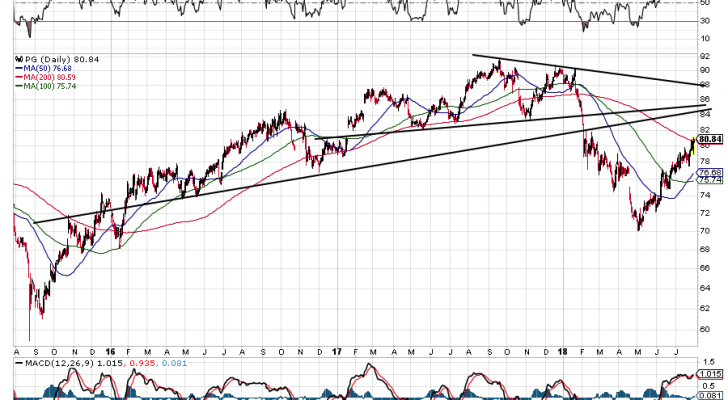

Procter & Gamble (NYSE:PG) reported a mixed bag when it comes to earnings. However, the stock shook off its early losses and was able to rally higher on the day. That can be seen in the short-term chart above.

Now above all three major moving averages and following its trend-line higher, its hard to too bearish on PG in the short-term. Below trend would be a different story, though.

On the adjacent long-term chart, you can see just how well P&G follows some of its trend-lines. While a run to the $84 to $85 range would be welcomed, I’d expect PG to hit some resistance in that area. Keep that in mind if you’re going long.

Top Stock Trades for Tomorrow #2: Sogou (SOGO)

Boy, have some of those hot Chinese tech stock cooled off or what? Right now we have Sogou (NYSE:SOGO), which is back to single digits despite beating on earnings and revenue after traffic acquisition costs soared in the quarter.

So what now? I love to use Fibonacci levels on these names, but have left them off in this case. We can see that the $8.75 area is a pretty important level. Short-term investors can use that as a level to trade against.

An area of interest below that mark would be $8. While it would require a big fall, don’t forget Sogou was down there just a few months ago. If the potential decline happens quickly enough, it may also find the backside of its prior downtrend line.

That would give us a great buying opportunity.

Top Stock Trades for Tomorrow #3: Caterpillar (CAT)

Despite raising guidance and beating earnings, Caterpillar (NYSE:CAT) isn’t having an easy time rallying. (Apologies on the marked up chart above).

Shares have been in a trading range between roughly $140 and $155, although it did overshoot those marks a few times. Anyway, strong support sits down on the low-$130s, while potential resistance is sitting somewhere between $152.50 and $155.

That’s where a few downtrend lines come into play, depending on which peaks we are connecting. Either way, CAT is running into all three major moving averages right now and would need to clear those first.

There’s too much resistance overhead to get me excited. I’d be more interested on a pullback to the $137.50 to $140 range, or in the low-$130s.

Top Stock Trades for Tomorrow #4: AbbVie (ABBV)

Shares of AbbVie (NYSE:ABBV) are making a pretty standard move, with $86 support and downtrend resistance both in play.

Now that ABBV is putting in a series of higher lows, we would ordinarily look for a push through downtrend resistance. However, all three major moving averages are also nearby and could act as resistance.

The conservative play? Wait for a close over the 200-day moving average and look for a run up toward $104 to $105. If we get it, it’s a quick 4% to 5% rally and that’s just fine in my book.

Top Stock Trades for Tomorrow #5: Emerging Market ETF (EEM)

The Emerging Markets ETF (NYSEARCA:EEM) is making a similar move, albeit with a slightly different setup.

While under some downtrend drawings the EEM has already broken over resistance, I do not want to give this one the benefit of the doubt given the current market climate. That’s why we drew a more conservative downtrend line above (blue).

A close over this level would essentially lock EEM as a buy for short-term bulls. Aggressive traders who want to own the EEM ahead of this possible breakout can do so and use the 50-day moving average is their level to trade against. This mark was once resistance, but is now acting as support.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long AAPL.

More From InvestorPlace

The post 5 Top Stock Trades for Wednesday — Is Procter Finally a Buy? appeared first on InvestorPlace.