May Top Undervalued Stocks To Look Out For

Hexindai and Escalade are stocks on my list that are potentially undervalued. This means their current share prices are trading well-below what the companies are actually worth. There’s a few ways you can value a company. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good investments.

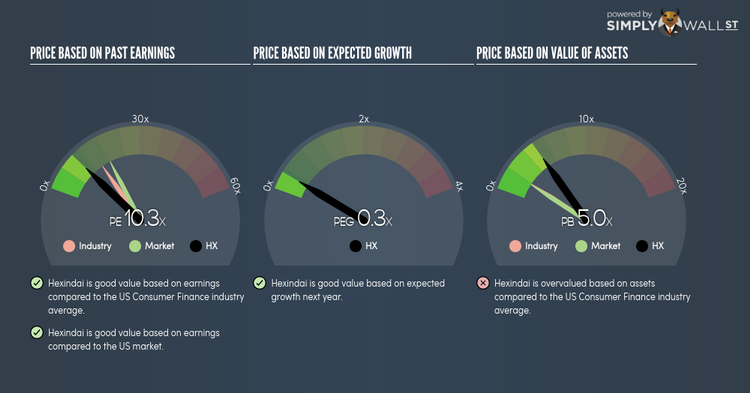

Hexindai Inc. (NASDAQ:HX)

Hexindai Inc., through its subsidiaries, operates an online consumer lending marketplace connecting borrowers and investors in the People’s Republic of China. Founded in 2013, and currently run by Xinming Zhou, the company provides employment to 315 people and with the market cap of USD $593.73M, it falls under the small-cap group.

HX’s stock is now hovering at around -62% lower than its actual level of $32.67, at a price tag of US$12.38, based on my discounted cash flow model. The divergence signals an opportunity to buy HX shares at a low price. Additionally, HX’s PE ratio stands at around 10.29x while its Consumer Finance peer level trades at, 15.1x meaning that relative to its comparable company group, we can invest in HX at a lower price. HX also has a healthy balance sheet, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. HX has zero debt on its books as well, meaning it has no long term debt obligations to worry about. Interested in Hexindai? Find out more here.

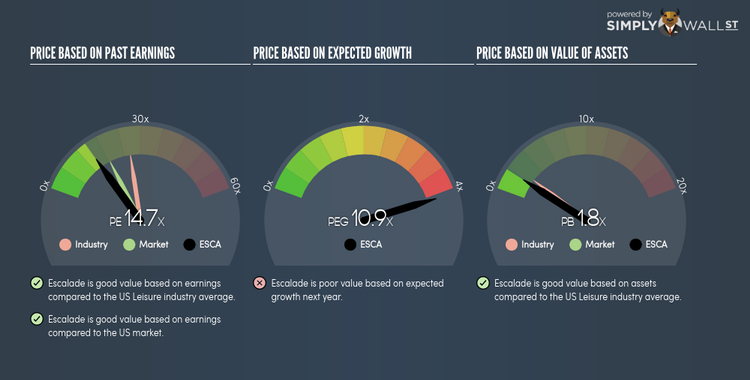

Escalade, Incorporated (NASDAQ:ESCA)

Escalade, Incorporated, together with its subsidiaries, manufactures and sells sporting goods in North America, Europe, and internationally. Started in 1922, and currently lead by David Fetherman, the company currently employs 501 people and with the company’s market capitalisation at USD $202.54M, we can put it in the small-cap group.

ESCA’s shares are currently trading at -58% lower than its true level of $33.87, at a price tag of US$14.20, according to my discounted cash flow model. signalling an opportunity to buy the stock at a low price. What’s even more appeal is that ESCA’s PE ratio is around 14.69x while its Leisure peer level trades at, 26.3x meaning that relative to other stocks in the industry, we can invest in ESCA at a lower price. ESCA is also robust in terms of financial health, with short-term assets covering liabilities in the near future as well as in the long run. The stock’s debt-to-equity ratio of 20.40% has been reducing over the past couple of years indicating its capacity to reduce its debt obligations year on year. More on Escalade here.

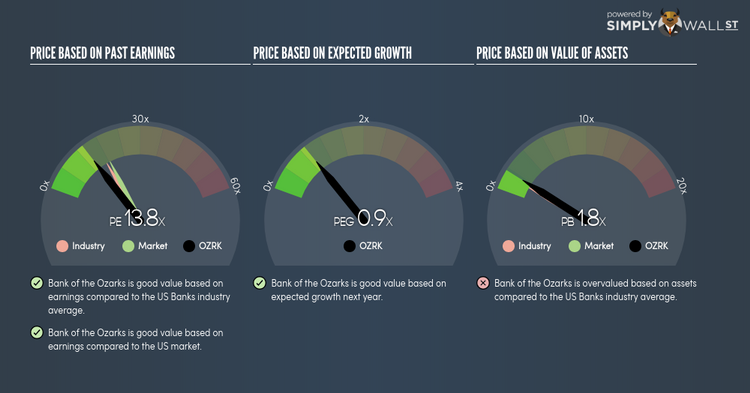

Bank of the Ozarks (NASDAQ:OZRK)

Bank of the Ozarks provides a range of retail and commercial banking services to businesses, individuals, and non-profit and governmental entities. Founded in 1981, and now run by George Gleason, the company employs 2,400 people and with the company’s market capitalisation at USD $6.32B, we can put it in the mid-cap stocks category.

OZRK’s shares are now trading at -71% beneath its true level of $164.31, at a price tag of US$48.45, based on my discounted cash flow model. This difference in price and value gives us a chance to buy low. In terms of relative valuation, OZRK’s PE ratio is currently around 13.83x while its Banks peer level trades at, 17.01x suggesting that relative to other stocks in the industry, you can purchase OZRK’s stock for a lower price right now. OZRK is also a financially healthy company, as short-term assets amply cover upcoming and long-term liabilities.

Dig deeper into Bank of the Ozarks here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.