Top Undervalued Financial Stocks To Buy Now

Financial service companies’ profitability tends to be tied to the economic cycle, mainly because these businesses offer services ranging from investment banking to consumer financing, which are in demand during prosperous economic times. Recent undervalued financial companies based on their current market price include Five Oaks Investment and Great Ajax. Smart investors can make money from this discrepancy by buying these shares, because they believe the current market prices will eventually move towards their true value. And those that want more exposure to the economic cycle should consider the following list of potentially undervalued financial stocks.

Five Oaks Investment Corp. (NYSE:OAKS)

Five Oaks Investment Corp., a real estate specialty finance company, focuses on investing in portfolio mortgage-backed securities (MBS), mortgages, and other real estate related assets. Five Oaks Investment was started in 2012 and has a market cap of USD $74.13M, putting it in the small-cap stocks category.

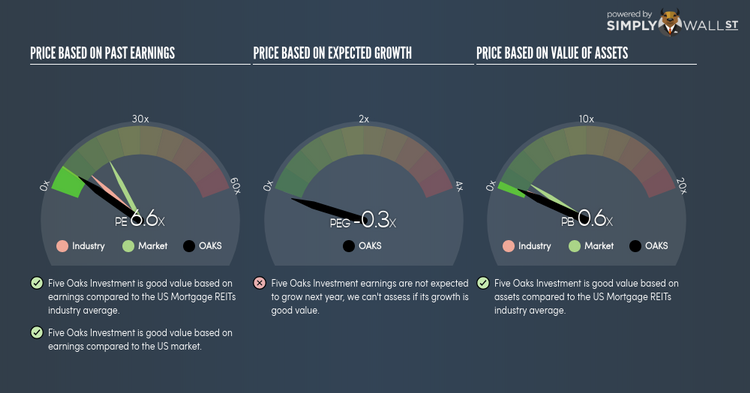

OAKS’s stock is now floating at around -42% below its true value of $5.38, at a price tag of US$3.10, based on its expected future cash flows. signalling an opportunity to buy the stock at a low price. In terms of relative valuation, OAKS’s PE ratio is currently around 6.58x compared to its Mortgage REITs peer level of, 9.75x indicating that relative to its comparable set of companies, you can buy OAKS’s shares at a cheaper price. OAKS is also a financially robust company, with current assets covering liabilities in the near term and over the long run.

More detail on Five Oaks Investment here.

Great Ajax Corp. (NYSE:AJX)

Great Ajax Corp. acquires, invests in, and manages a portfolio of residential mortgage and small balance commercial mortgage loans. Great Ajax was started in 2014 and with the company’s market capitalisation at USD $255.06M, we can put it in the small-cap group.

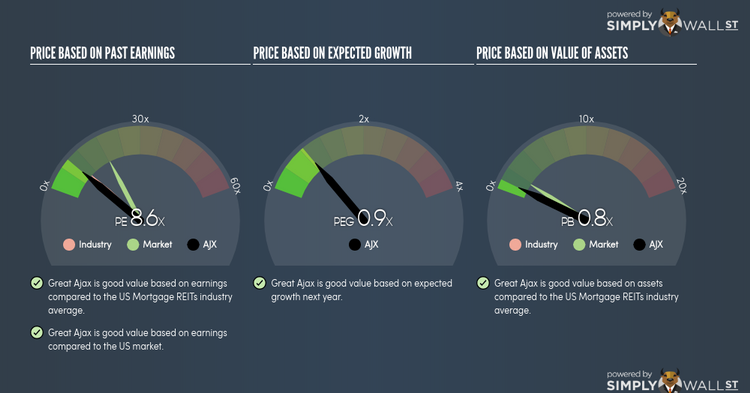

AJX’s shares are now floating at around 16% lower than its actual worth of $11.37, at a price tag of US$13.19, according to my discounted cash flow model. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. Furthermore, AJX’s PE ratio is around 8.62x against its its Mortgage REITs peer level of, 9.75x implying that relative to other stocks in the industry, you can buy AJX for a cheaper price. AJX is also in great financial shape, as current assets can cover liabilities in the near term and over the long run.

More detail on Great Ajax here.

Oxford Square Capital Corp. (NASDAQ:OXSQ)

TICC Capital Corp. is a business development company, operates as a closed-end, non-diversified management investment company. Oxford Square Capital was established in 2003 and with the stock’s market cap sitting at USD $346.17M, it comes under the small-cap category.

OXSQ’s shares are now trading at -26% below its value of $9.37, at a price tag of US$6.90, based on my discounted cash flow model. This mismatch indicates a chance to invest in OXSQ at a discounted price. In addition to this, OXSQ’s PE ratio is trading at around 8.24x compared to its Capital Markets peer level of, 16.17x implying that relative to its comparable set of companies, you can buy OXSQ’s shares at a cheaper price. OXSQ is also strong financially, as short-term assets amply cover upcoming and long-term liabilities. The stock’s debt-to-equity ratio of 16.26% has been diminishing for the past few years demonstrating its capacity to pay down its debt. Continue research on Oxford Square Capital here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.